tesla tax credit 2021 north carolina

An average 8 kilowatt kW system would be eligible for a rebate of 3200. Tesla tax credit 2021 north carolina Sunday February 27 2022 Edit.

Ev Sales Waiting For The Inflection Electrification Coalition

The effective date for this is after December 31 2021.

. Top content on Tax Tax Credit and Tesla as selected by the EV Driven community. A 12500 tax credit for the purchase of an EV is on the table but has a long way to go. Opry Mills Breakfast Restaurants.

In this example if you owe 7500 in taxes you will only need to pay 480 after claiming the solar ITC on your solar PV system 7500. Duke Energy has run out of available funds for rebates in the first half 2022. The retail sale use storage and consumption of alternative fuels is exempt from the state retail sales and use tax.

The tiles have an ASTM D3161 Class F wind rating and a ANSI FM 4473 Class 3 hail rating. Tax credits for heavy duty electric vehicles with 25000 in credit available in 2017 20000 in 2018 18000 in 2019 and 15000 in 2020. Clean Cities Coalitions North Carolina is home to the following.

Tesla and GM are set to. Are Dental Implants Tax Deductible In Ireland. Expired Repealed and Archived Laws and Incentives View a list of expired repealed and archived laws and incentives in North Carolina.

You can get a tax credit of 25 for any alternative fuel infrastructure project including building an electric. Local and Utility Incentives. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit.

Tesla is seeing a delay in its lithium supply for next year as a North Carolina mining. That eliminates several Tesla models. Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the customer.

To begin with some feel it sends the wrong message discouraging. Nissan is expected to be the third manufacturer to hit the limit but. It does not qualify when installed without solar or if solar is installed after Powerwall.

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired Tesla Model S 3 X Y In California Now Eligible For Additional 1 500 Tesla Earns Modest Q2 Profit Delivers 5. 35 tax credit on price of an EV up to 1500 for a BEV and 1000 for a PHEV. BEVs exempt from states 65 sales tax.

If you purchased a new EV in May of 2021 you would apply for the tax credit when you file your 2021 taxes at the beginning of 2022. The fees presence has created a highly controversial debate leaving the public divided in their opinions. What about Tesla.

PHEVs exempt from states 03 motor vehicle sales tax. Thats all fancy jargon to say the tiles are tested to hold up to 110mph winds and 1 ¾ inch hail. Tesla Solar Shingle Specs.

Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger. At least 50 of the qualified vehicles miles must be driven in the state and the credit expires at the end of 2020. The following perks include electric car emissions test exemptions high occupancy vehicle HOV lane access federal tax incentives auto insurance discounts and more.

Certainly theres a better way to process rebate claims as thereve been reports of challenges getting these credits from solar installers. To get a better grasp on how the fee is affecting the North Carolina EV community we reached out to several Plug-in NC ambassadors to hear their positions on the tax. Some state have income caps or special rules for Teslas in particular due to the higher MSRP of some Tesla modelsand the fact that Teslas are not sold through typical franchise dealerships.

The 2021 Jeep Wrangler 4xe combines a. Teslas solar shingles are a sleek slate grey at 15x45 and come with a 25 year tile power and weatherization warranty. Tesla Tax Credit 2021 North Carolina.

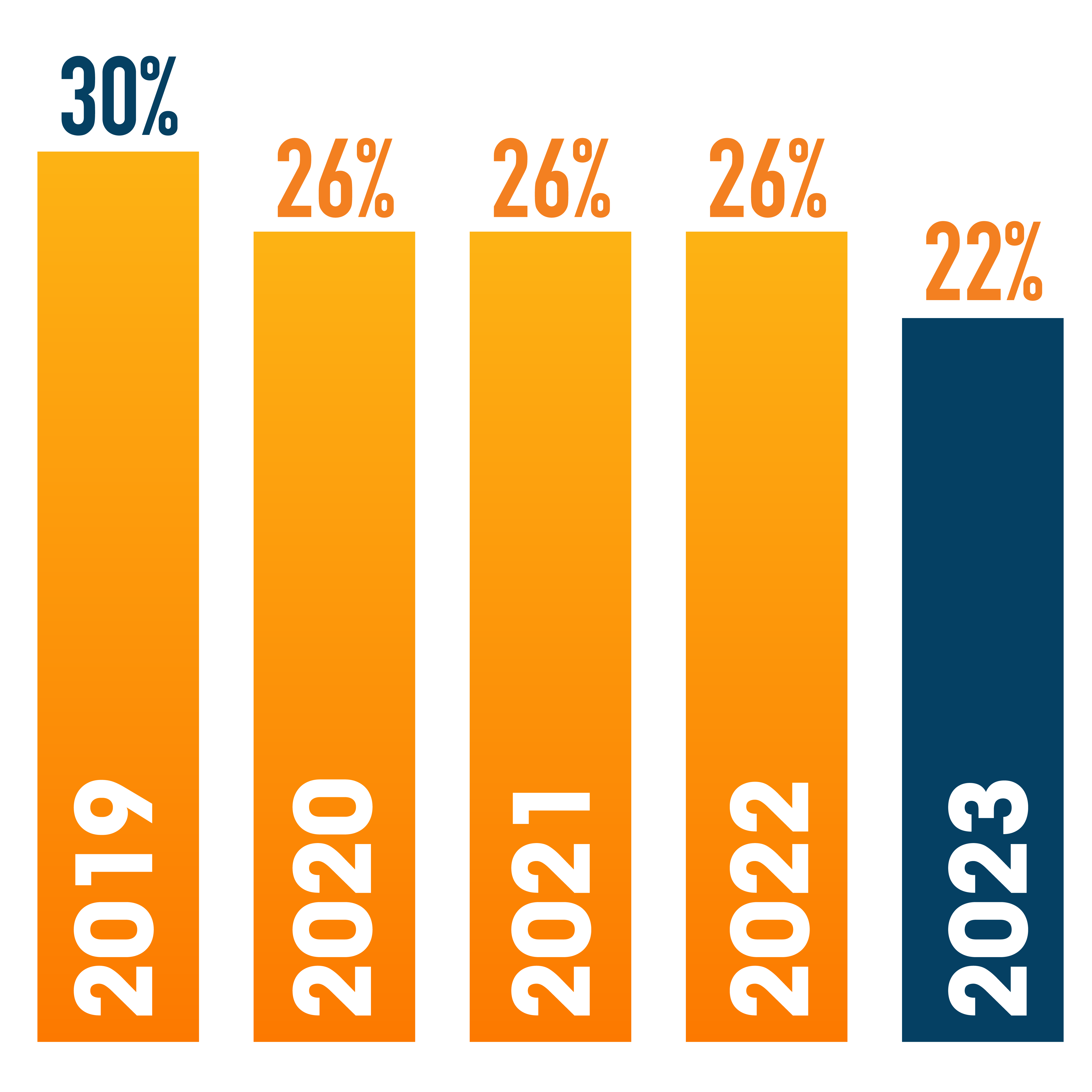

Then from October 2019 to March 2020 the credit drops to 1875. Regardless if you go solar in 2021 you can work with your installer to claim the 6000 in early 2022. Powerwall is designed to qualify for the Federal Tax Credit when it is installed on an existing or new solar system and is charged 100 with solar energy.

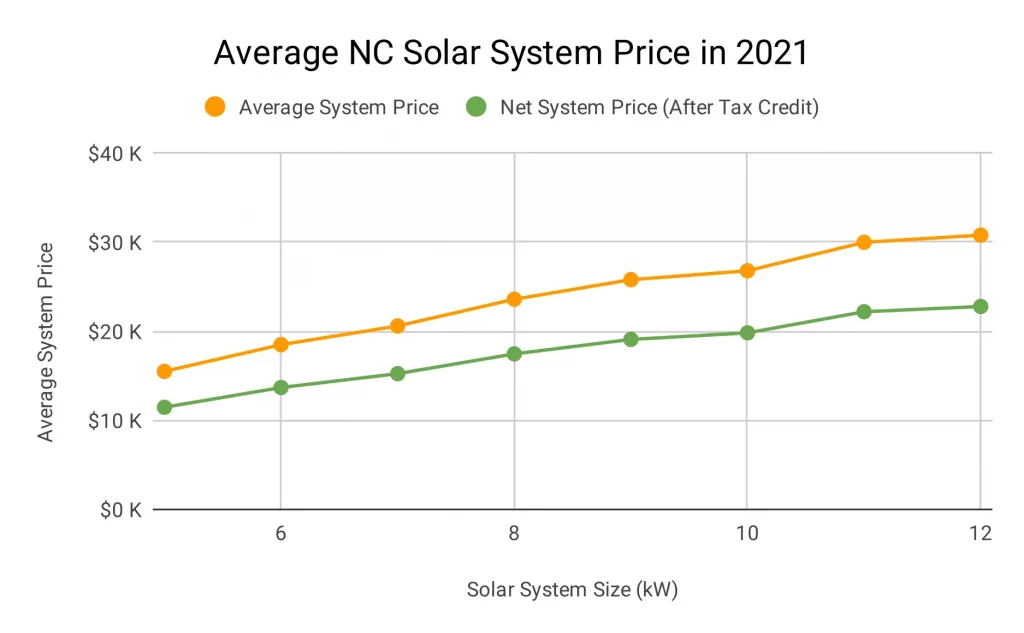

Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. This means for an average 27000 solar system the homeowner can claim around a 7020 credit when filing their 2021 taxes. After that the credit phases out completely.

North Carolina offers a state emissions testing exemption and car pool lane access to electric and alternative fuel vehicles. Solar customers can join a waitlist. Reference North Carolina General Statutes 105-16413.

From April 2019 qualifying vehicles are only worth 3750 in tax credits. A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. Make the tax credit refundable meaning that someone with a tax liability of only 3500 could get the full benefit of the 7500 credit as they would receive a 4000 tax refund.

North Carolinas green-minded drivers can save time and money through numerous eco-friendly driving incentives. Points of Contact Get contact information for Clean Cities coalitions or agencies that can help you with clean transportation laws incentives and funding opportunities in North Carolina. Majestic Life Church Service Times.

There are also many state-specific tax credits rebates and other incentives. Discounted charging rate. Oregon offer a rebate of 2500 for purchase or lease of new or used Tesla cars.

11th 2021 622 am PT. Tesla vehicles no longer qualify for the base 7500 and unfortunately will not qualify for the additional 5000 if the bill remains as is. Anyone who purchases a Tesla in any state can get 7500 knocked off their federal tax bill as a credit.

Restaurants In Matthews Nc That Deliver. Charging station parts and labor costs also exempt from state sales tax. Restaurants In Erie County Lawsuit.

There are also rebates available for nonresidential customers worth 030Watt up to 30000 and for nonprofit customers worth 075Watt up to 75000. Electric Vehicles Solar and Energy Storage. 2nd 2021 948 am PT.

The list below contains summaries of all North Carolina laws and incentives related to electricity. You should always consult your tax professional for your situation. State Incentives Alternative Fuel Tax Exemption.

Green Driver State Incentives in North Carolina. A refundable tax credit is not a point of purchase rebate. Tax credit up to 50 of cost or 2500 for an EV conversion.

Latest On Tesla Ev Tax Credit March 2022

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Nc Solar Incentives To Take Advantage Of In 2022 Southern Energy Management

Tesla S Fremont Car Plant Was Most Productive In North America In 2021 Report Car News

Nys Electric Vehicle Rebate At Hoselton Auto Mall In East Rochester Ny New Pre Owned And Certified Vehicles

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Residential Solar Tax Incentives Renu Energy Solutions

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Car Tax Credits What S Available Energysage

Apply For A Rebate Clean Vehicle Rebate Project

Why You Can T Buy A Tesla In Some States

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Bmw Vs Tesla Brand Model Comparison Bmw Of Southpoint

Ev Sales Waiting For The Inflection Electrification Coalition

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Used Tesla For Sale In Lexington Nc Jerry Hunt Supercenter

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels